LTC Price Prediction: Can Litecoin Surge to $200?

#LTC

- Technical Strength: LTC trades above 20-day MA with MACD convergence signaling potential reversal.

- Institutional Adoption: MEI Pharma's treasury move validates LTC as a corporate reserve asset.

- Regulatory Wildcard: SEC's ETF flip-flop may dampen institutional participation short-term.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

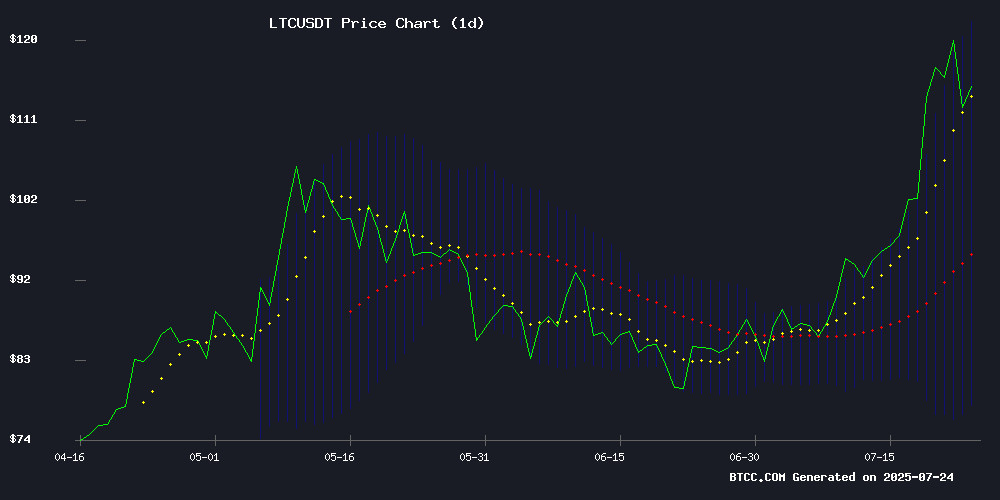

According to BTCC financial analyst James, Litecoin (LTC) is currently trading at $113.60, above its 20-day moving average of $99.95, indicating a bullish trend. The MACD remains negative but shows signs of convergence, suggesting weakening downward momentum. Bollinger Bands indicate volatility, with the price near the upper band at $121.57, hinting at potential overbought conditions. A break above $121.57 could target $125 in the short term.

Litecoin Gains Momentum Amid Positive Market Sentiment

BTCC analyst James notes that Litecoin is attracting bullish attention, with headlines targeting $120-$125. Institutional interest, like MEI Pharma's $100M treasury commitment, adds credibility. However, SEC's ETF reversal highlights regulatory uncertainty. Whale activity and profit-taking by Cardano/LTC traders may cause short-term volatility, but the overall sentiment leans bullish.

Factors Influencing LTC's Price

Litecoin Gains Momentum as Bulls Target $120-$125 Range

Litecoin (LTC) has surged 20% in the past week, trading at $116 with a notable 1.30% increase in daily volume to $1.27 billion. The rally follows a 24% weekly gain, peaking at $119.21, as market participants anticipate further upside.

Analyst Naveed highlights a key resistance breakout, confirming a "fair value gap" fill before the upward move. The $120-$125 zone now serves as the next technical target. Long-term projections suggest a potential 2025 rally toward $262, though volatility may include a pullback below $94 before challenging its all-time high of $413.

Best Crypto To Buy Now: Litecoin And Shiba Inu Grow Whilst This New Altcoin DeSoc Could 300% Next Week

Meme coins are experiencing a resurgence in July, with shiba inu leading the charge amid bullish price predictions. Investors are turning their attention to altcoins like Litecoin and DeSoc, a new project generating significant buzz. Market momentum suggests both established coins and emerging contenders could see substantial gains.

Litecoin has rallied to $115, with analysts forecasting a rise to $138 by month's end and $180 by late 2025. Technical indicators, including a completed Gartley pattern, point to a potential trend reversal. Despite recent volatility, the overall structure remains bullish above $95, making Litecoin a compelling option for traders and long-term holders alike.

Shiba Inu's surge is backed by increased open interest and trading volumes, signaling renewed appetite for meme coins. Meanwhile, DeSoc's rapid ascent has captured market attention, with some predicting a 300% gain in the coming week. The altcoin market is poised for dynamic movement, offering opportunities for strategic investors.

SEC Grants Then Revokes Approval for Bitwise's Multi-Crypto ETF in Dramatic Policy Reversal

The Securities and Exchange Commission executed a stunning about-face on July 22, initially approving then abruptly staying Bitwise's proposed 10-asset cryptocurrency ETF. The fund would have tracked major digital assets including Bitcoin, Ethereum, XRP, Solana, Cardano, and Litecoin, with concentrated exposure to SEC-approved components.

NYSE Arca received rule change authorization before Assistant Secretary Sherry Haywood invoked Rule 431, freezing the conversion pending full Commission review. The reversal came despite the SEC's own finding that the proposal met Exchange Act requirements for investor protection - a decision that leaves the crypto industry questioning the regulator's consistency.

MEI Pharma Pioneers Litecoin Treasury Strategy With $100 Million Commitment, Stock Surges

MEI Pharma's bold pivot into cryptocurrency reserves has electrified markets. The biopharmaceutical firm's stock (MEIP) doubled in five days after revealing plans to allocate $100 million from a private placement to Litecoin acquisitions. This positions MEI as the first Nasdaq-listed company to hold LTC as primary treasury reserves.

Charlie Lee, Litecoin's creator, joined crypto market maker GSR as lead investors in the $100 million PIPE deal. The financing round attracted heavyweight participants including the Litecoin Foundation and institutional firms like ParaFi and HiveMind. MEI's treasury maneuver reflects growing institutional confidence in digital assets as viable reserve holdings.

The market response speaks volumes - MEIP's 100% surge demonstrates investor approval of corporate crypto adoption. This landmark case may accelerate treasury diversification strategies among cash-rich public companies seeking inflation-resistant assets.

Litecoin Price Analysis: Can LTC Break $250 After Historic Market Demand? Whales Prefer This AI Coin

Litecoin's price action is gaining momentum as institutional interest surges, with Nasdaq-listed MEI Pharma allocating $100 million to LTC reserves. Supported by Titan Partners and GSR, this strategic move coincides with Litecoin creator Charlie Lee joining MEI's board. LTC currently trades NEAR $115, showing resilience despite market volatility.

Technical indicators suggest potential upside, with a golden cross forming on daily charts and RSI hovering near overbought territory. Analysts note growing whale activity in major LTC wallets, reinforcing the bullish case. Key resistance levels stand at $120 and $250, though a pullback to $100 could present a buying opportunity.

Meanwhile, Unilabs—an AI-managed DeFi platform with $30 million in assets under management—is attracting significant capital flows. This emerging competition between established cryptocurrencies and AI-powered alternatives may define investment trends through 2025.

Cardano and Litecoin Traders Secure Profits Amid Market Rally, While Unilabs Emerges as a New Contender

Cardano's price surged past $0.883, marking a 20% weekly gain as altcoin season gains momentum. The integration of ADA into Blockchain.com's DeFi wallet and an upcoming financial audit have bolstered investor confidence. Litecoin mirrored these gains, with traders capitalizing on a 30% uptick.

Meanwhile, Unilabs Finance enters the spotlight as a disruptive DeFi asset manager leveraging AI for high-yield, low-risk strategies. The platform has already sold 1 billion tokens, signaling strong early demand. Its algorithmic approach positions it as a potential outperformer against established assets like ADA and LTC.

Will LTC Price Hit 200?

While LTC shows strong technical and sentimental momentum, reaching $200 would require a 76% surge from current levels. Key factors include:

| Factor | Impact |

|---|---|

| Technical Resistance | $121.57 (Upper Bollinger Band) |

| Institutional Demand | MEI Pharma's $100M commitment |

| Market Sentiment | Bullish but mixed (ETF uncertainty) |

James suggests monitoring the $125 breakout level for confirmation of extended upside.